Getting Started with eTax

Filing your Returns

Managing PAYE, Withholding Tax

Proceed to Make Payment

Follow step-by-step instructions to complete payment

Payment can be made online or through any bank branch. Please note payment should be done through Remita, Paystack or eTranzact(webConnect).

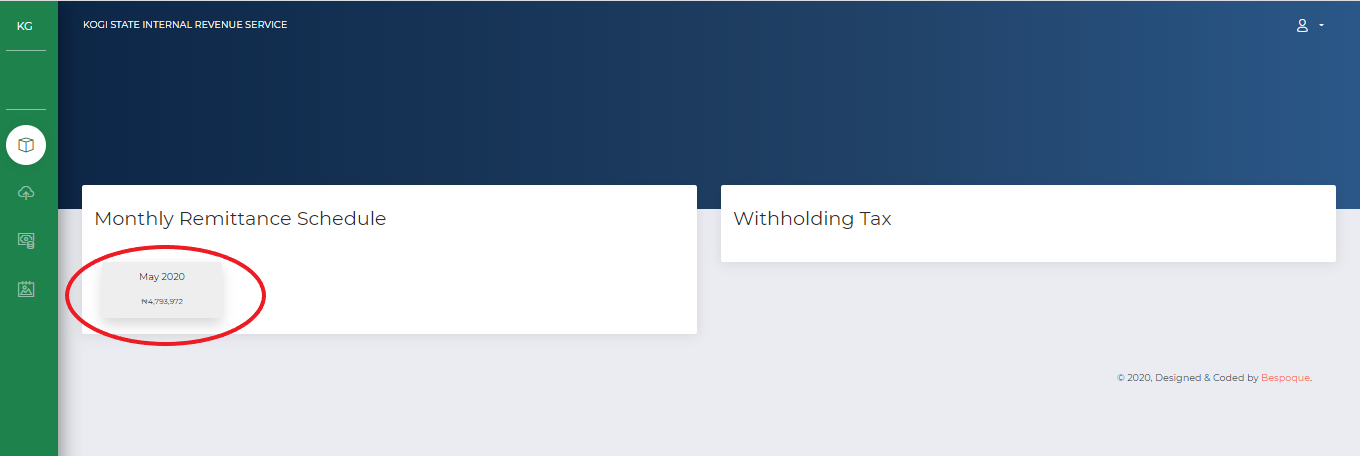

Upon successful filing (monthly remittance and withholding tax schedule), you will be redirected to the payment page. To continue with online payment click on the pending invoice you wish to pay for.

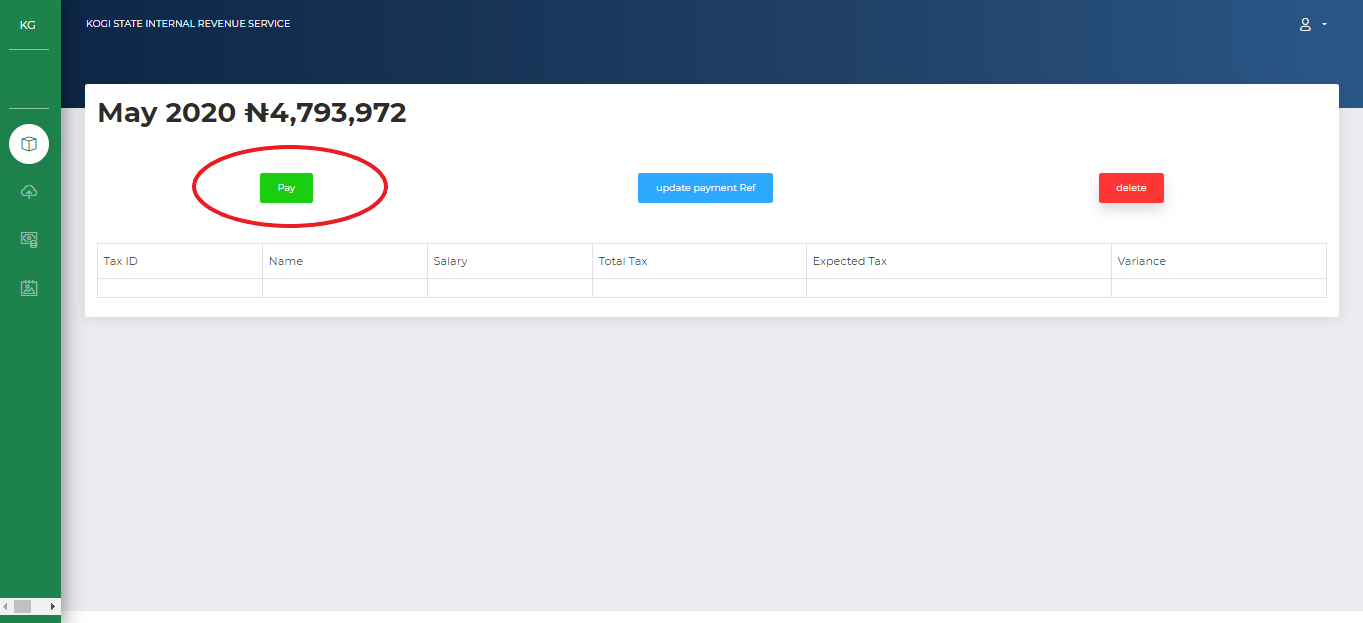

To continue with online payment, click on PAY.

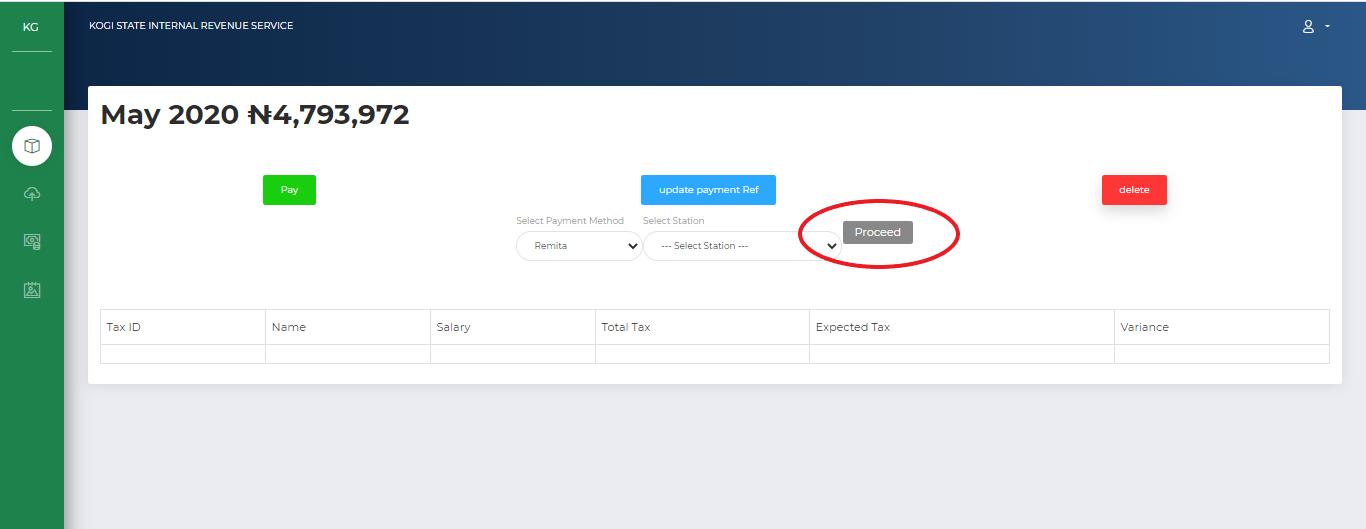

Select payment method and the tax station on the dropdown that pops up and click on PROCEED.

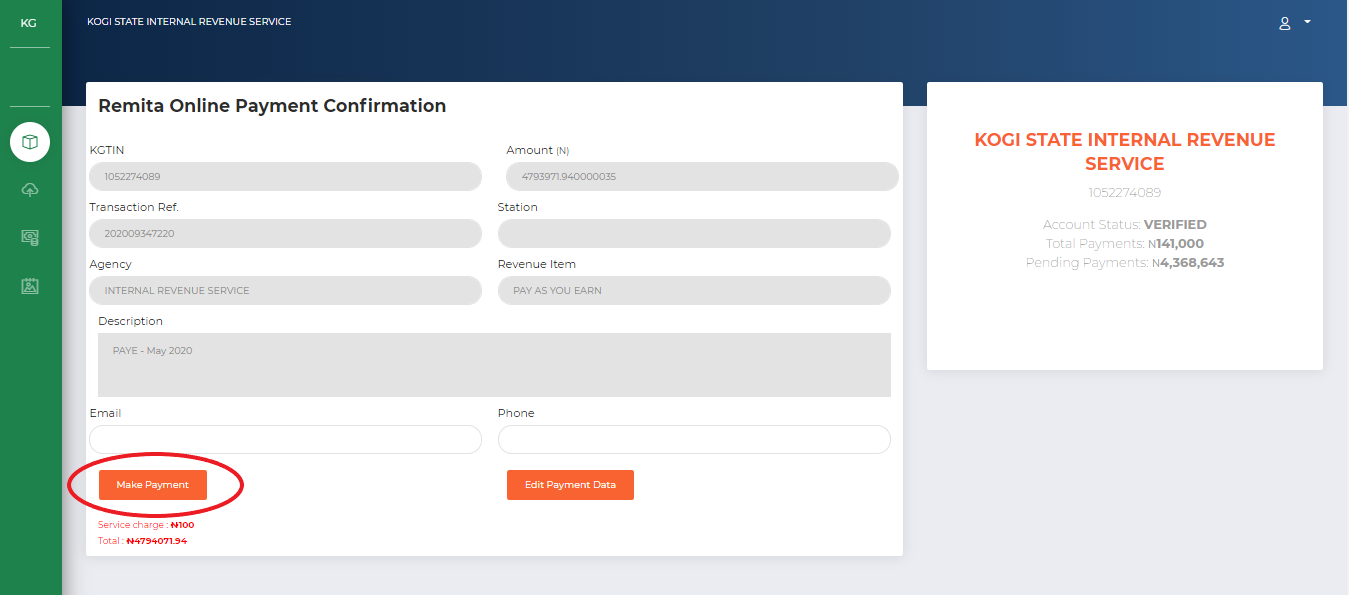

On the service payment provider confirmation page, provide you email and phone number, click on MAKE PAYMENT.

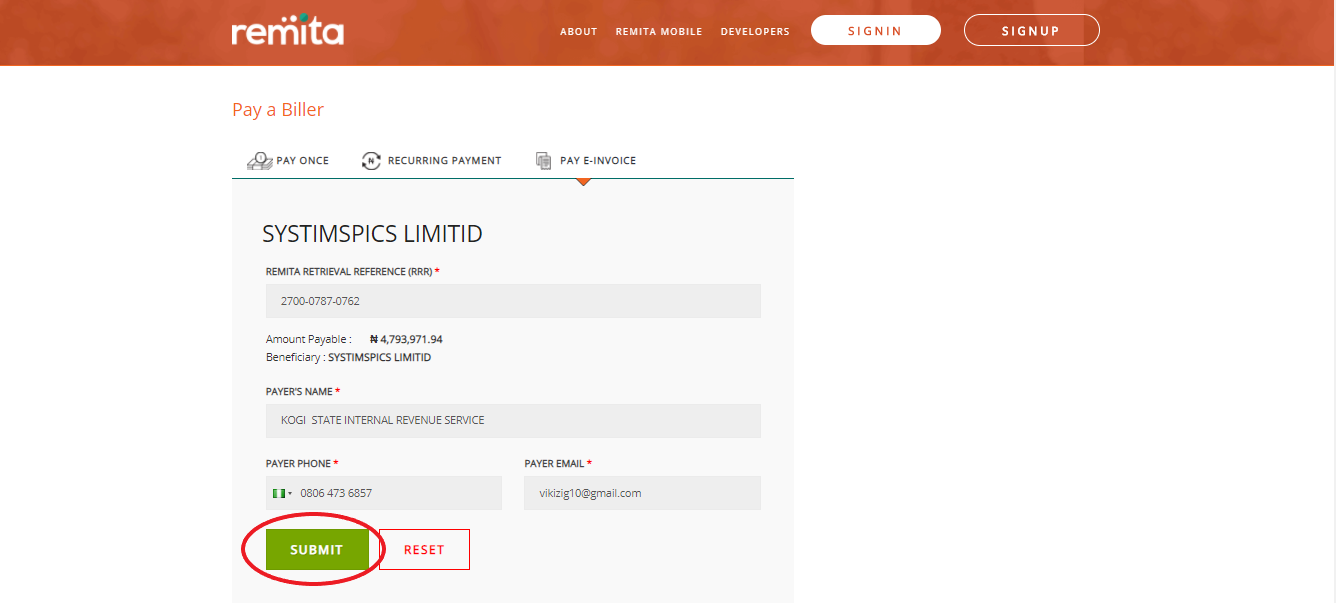

Click SUBMIT if satisfied with all the information on the service payment provider page.

Provide your card details and click on PAY.

Enter one time password sent by your service provider and click PAY.

Upon successful payment you will be redirected to the successful payment page.

Bank payment must be made through remita, paystack or eTranzact( webConnect) with your KGTIN. Payment can be made before or after uploading schedule. Ensure to update payment reference on the the portal after payment.

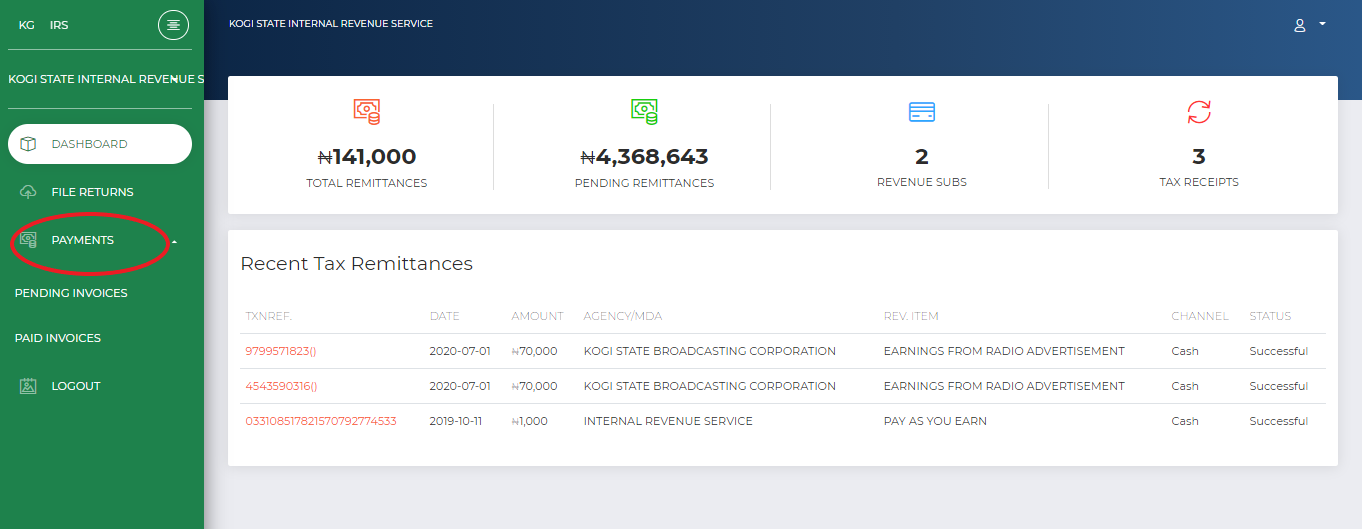

To update Reference number from the dashboard, click on PAYMENT button.

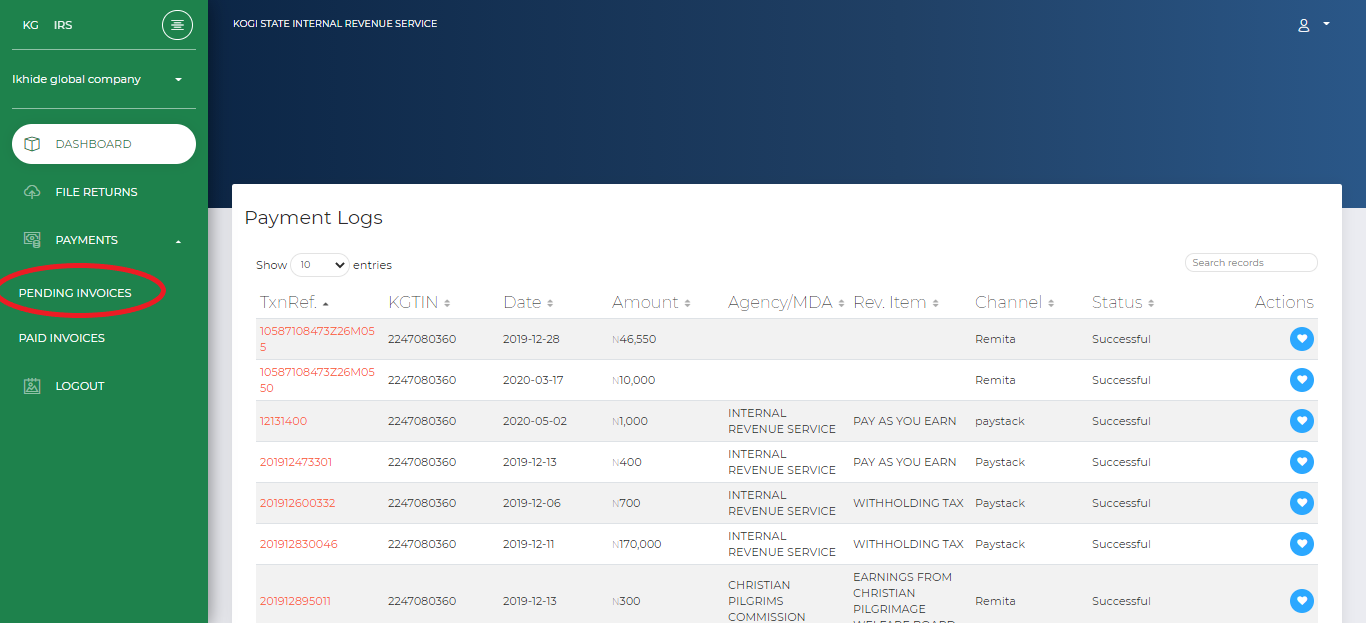

Click on PENDING INVOICES to navigate to the payment page..

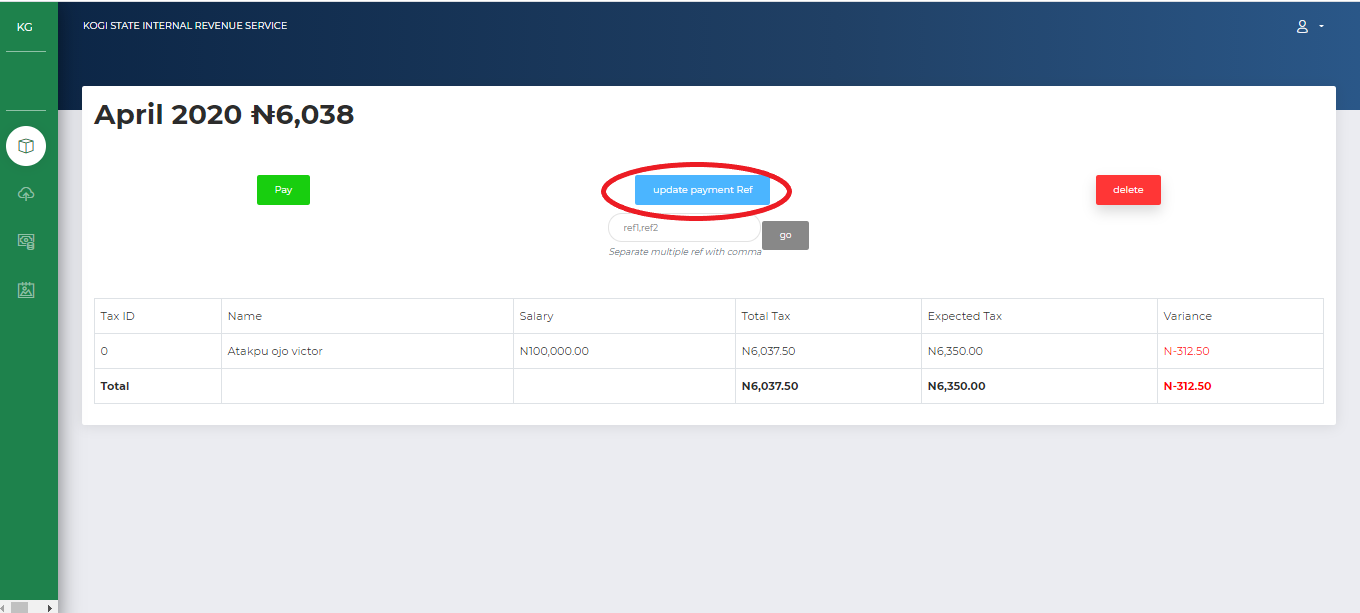

Buttons are provided to pay, update and delete record with details of the selected invoice.Click on ENTER PAYMENT REFERENCE NUMBER.

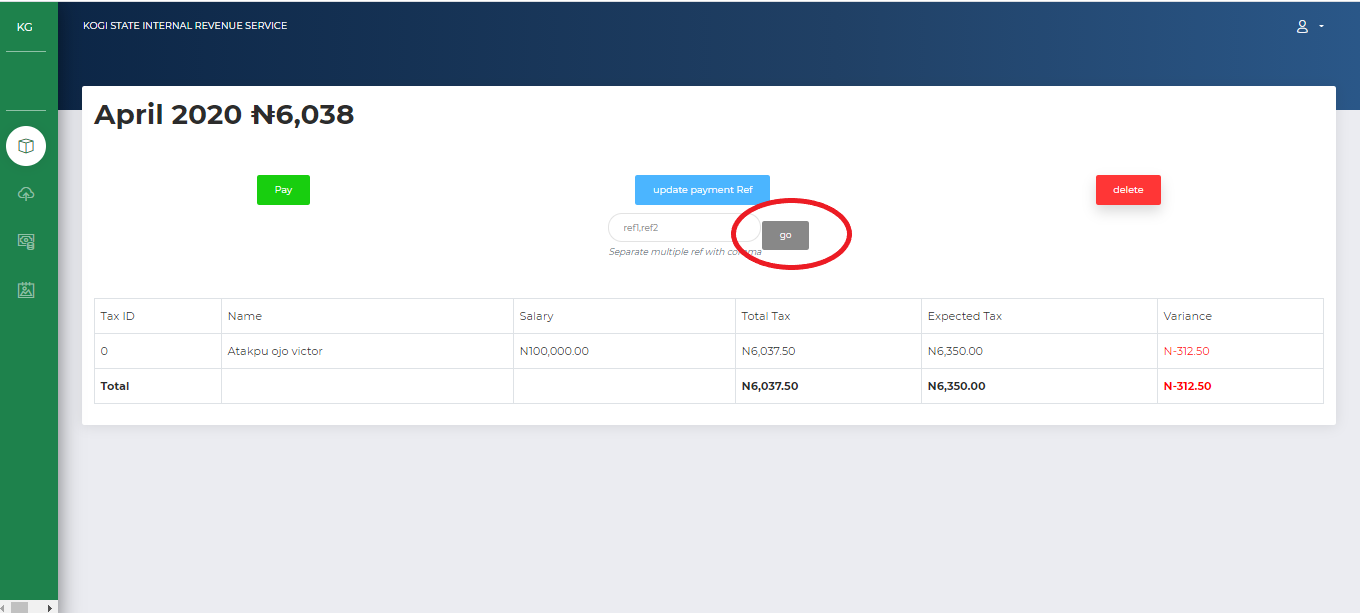

Fill the dropdown provided with the Payment Reference gotten from the Bank then click on GO.

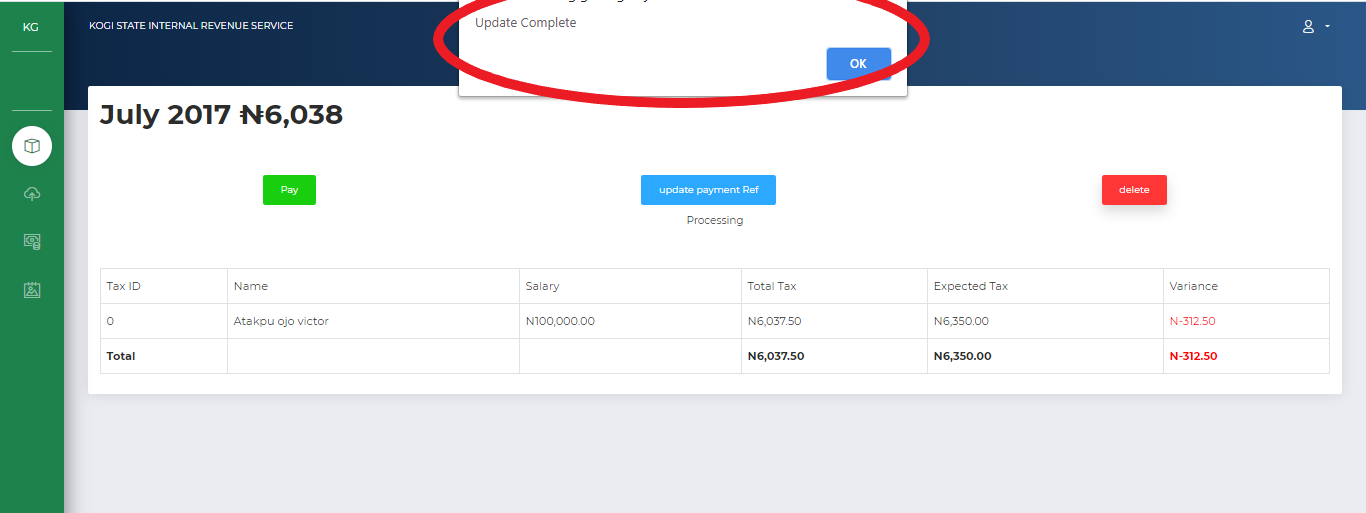

Upon successful update, you will be prompted..