Getting Started with eTax

Filing your Returns

Managing PAYE, Withholding Tax

Introduction: Easy Management of PAYE and Withholding Tax

A step-by-step guide to filing returns / schedules.

The eTax portal is designed to automate payment, filing of PAYE and Withholding taxes. Taxpayers get to see their tax history and can print receipt from this site.

This guide will walk you through the steps to use the eTax portal. A document template for download is provided; taxpayers can choose convenient payment option of their choice.

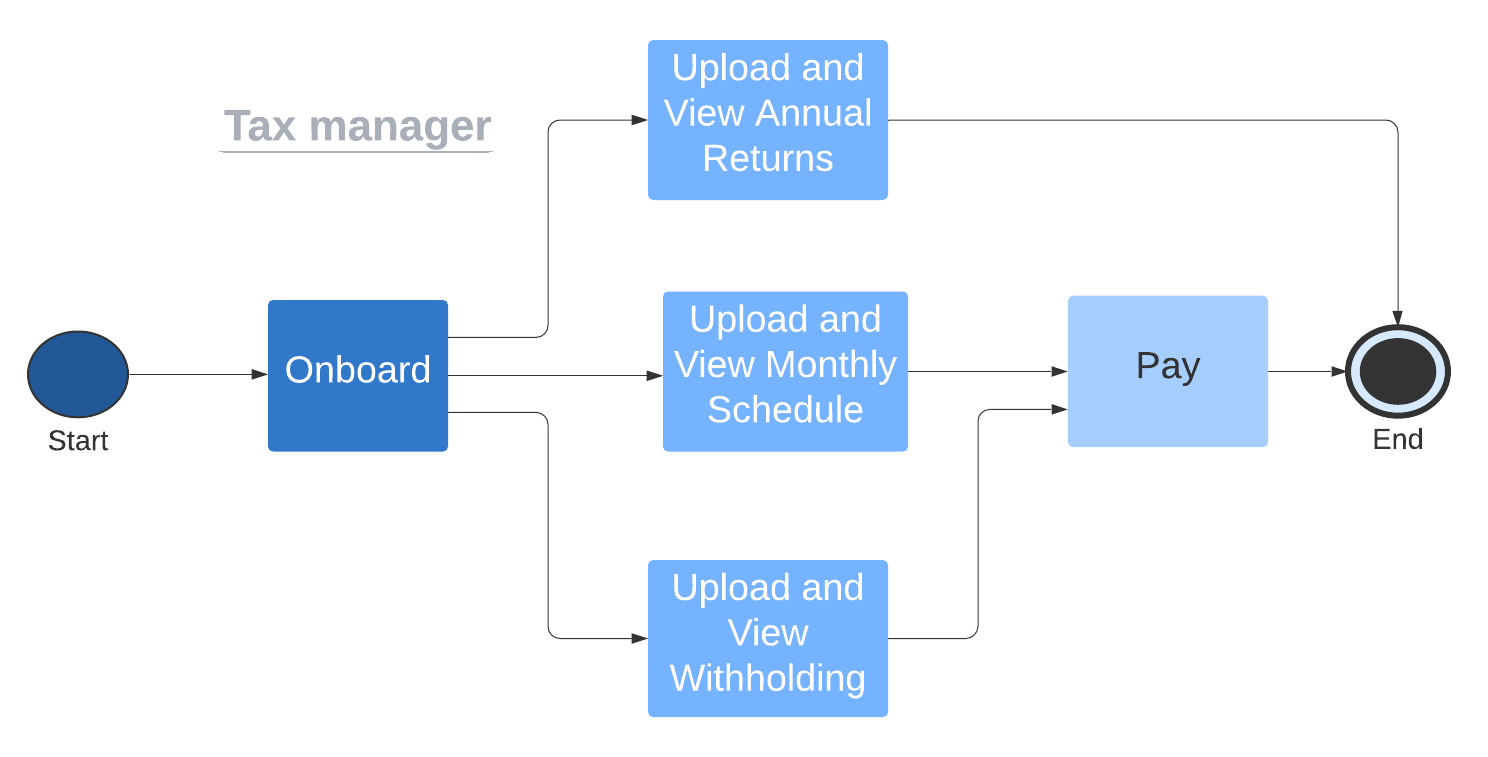

The diagram below provides a visual representation of the eTax portal. This is to help understand the activities that can be carried out on the portal.

This guide is divided into four short chapters